Tesla, Inc. (NASDAQ:TSLA) has been lowering the prices of its Model 3 and Model Y vehicles in the U.S. market, sparking concerns among some investors and analysts. A fund manager who holds Tesla as his second-largest position in his flagship exchange-traded fund said the price cuts could negatively affect the company’s earnings per share (EPS) projections.

Tesla’s Aggressive Pricing Strategy

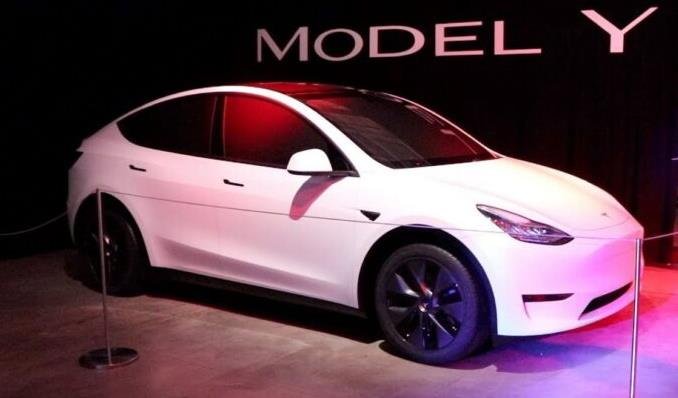

Tesla adjusted the configurator prices of the Model 3 and Model Y vehicles in the U.S. on its website late Thursday to imply a downward adjustment of 2.65%-4.23%. Here’s how the prices have changed for the Elon Musk-led company’s two best-selling EVs:

| Model 3 Trim Type | Previous Price | Current Price | Change |

|---|---|---|---|

| Rear-wheel drive | $40,240 | $38,990 | -3.11% |

| Dual-motor all-wheel drive Long Range | $47,240 | $45,990 | -2.65% |

| Dual-motor all-wheel drive Performance | $53,240 | $50,990 | -4.23% |

| Model Y Trim Type | Previous Price | Current Price | Change |

|---|---|---|---|

| Dual-motor all-wheel drive Long Range | $50,490 | $48,490 | -3.96% |

| Dual-motor all-wheel drive Performance | $54,490 | $52,490 | -3.67% |

The company left the recently introduced rear-wheel drive Model Y unchanged at $43,990. Now a customer can own a Tesla Model 3 for as little as $31,490, taking into account the reduced pricing and factoring in the $7,500 EV tax credit.

Black Warns Of Negative EPS Rerating

“There is no way to sugar coat this,” said Gary Black, a Tesla investor and Managing Partner at Future Fund, which has Tesla as its second-highest holding in its flagship exchange-traded fund.

If the Model 3 and Model Y price cuts impact just North American models, Black expects Wall Street analysts will likely cut their 2024 earnings per share estimate for Tesla by another $0.30-$0.50 per share.

He also noted that the Model 3 and Model Y price cuts implemented ahead of the current cuts have not brought in the desired results. ” M-3 and M-Y elasticities that have so far proven to be non-existent,” the fund manager said.

“At an annual cost of $1.2B, we continue to view price cuts as short-term thinking vs. the long-term benefits that TSLA could achieve through a $100M advertising investment that attracts non-EV buyers to go electric, which benefits TSLA most,” he added.

Black also expressed concerns that investors may assume more price cuts if these price cuts also prove impotent. He said this is especially because Musk previously hinted at making up for the profit hit by selling more full self-driving packages.

Tesla Shares Down Despite Record Deliveries

Tesla shares ended Thursday’s session at $260.05, down 0.43%, according to Benzinga Pro data. The stock has been under pressure despite the company reporting record deliveries of 241,300 vehicles in the third quarter of 2023, beating analysts’ expectations.

Some analysts have attributed the lackluster performance of Tesla shares to valuation concerns, supply chain issues, regulatory hurdles, and competition from other EV makers.

Tesla is expected to report its third-quarter earnings later this month. Analysts on average expect the company to report EPS of $1.57 on revenue of $13.82 billion, according to Refinitiv data.