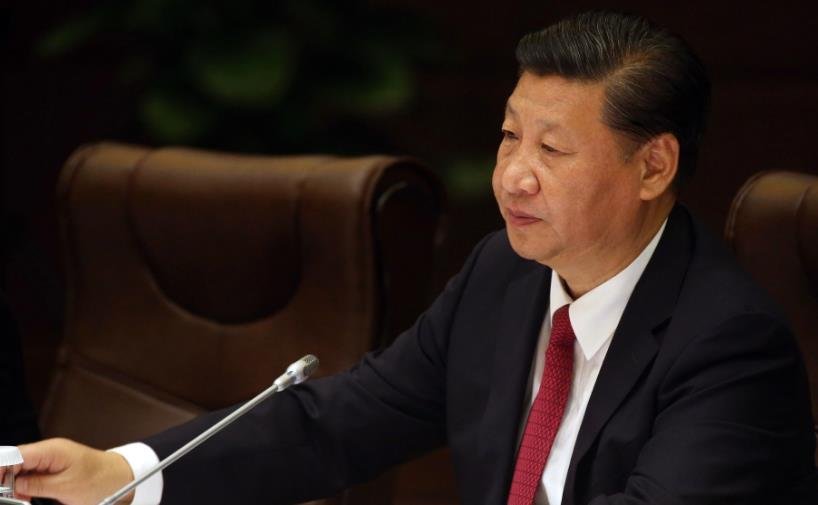

Chinese President Xi Jinping made an unprecedented visit to the nation’s central bank and foreign exchange regulator on Tuesday, according to people familiar with the matter, signaling his increased focus on shoring up the economy and financial markets amid multiple challenges.

Xi, along with Vice Premier He Lifeng and other government officials, visited the People’s Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) in Beijing in the afternoon, said the people, who asked not to be identified discussing private information. The vice premier also visited the nation’s sovereign wealth fund, the people added.

While details of the visits were not immediately clear, Xi’s movements are closely monitored by investors for potential policy signals. The most powerful Chinese leader since Mao Zedong has never appeared at the PBOC, according to public records, and his visit would highlight recent Communist Party rhetoric on its “centralized and unified” leadership over the financial industry. Previous such inspections were often led by the nation’s premiers or their deputies.

Xi’s presence reinforces a string of recent moves by the government to boost growth and stabilize markets. It could help ease concerns among some investors that the president had been neglecting the economy amid a purge of senior ministers and a volatile relationship with the US. His visit to the foreign exchange regulator is partly aimed at better understanding China’s $3 trillion of foreign-exchange reserves, one of the people said.

China battles to boost growth, stabilize financial markets

The world’s second-largest economy grew faster than expected in the third quarter, but there are deeper concerns about continued weakness in private sector activity and a lack of longer-term reforms needed to shift the economy to consumer-led growth.

The PBOC, which delivered modest interest rate cuts and has pumped more cash into the economy in recent weeks, is constrained in how much it can ease monetary policy for fear of stoking capital flight and hurting the yuan, analysts said.

Capital outflows from China rose sharply to $75 billion in September, the biggest monthly figure since 2016, Goldman Sachs’ preferred gauge of foreign exchange flows showed, underscoring intensifying depreciation pressure on the yuan.

Authorities have resorted to a battery of measures this year to address the nation’s faltering markets, an exodus of foreign funds, as well as worsening woes at the property sector and local government financing vehicles. While the economy has showed some signs of improvement, markets have continued to suffer as investor confidence has plummeted. More recently raids on foreign consulting firms and tightening of data security have further dented prospects.

Xi’s latest visit may prompt more policy action

Xi’s latest visit may prompt officials to further tap into their policy toolboxes to shore up the world’s second-largest economy and safeguard financial stability. Policymakers have so far refrained from using massive stimulus and more forceful direct intervention in the markets.

Central Huijin Investment Ltd., a unit of the $1.4 trillion wealth fund CIC, on Monday bought an undisclosed amount of exchange-traded funds and vowed to keep increasing its holdings in the latest attempt to boost the country’s slumping stock market.

The visit comes as state leaders, regulators and top bankers are set to gather at a closed-door financial policy meeting early next week to set medium-term priorities for the $61 trillion industry and prevent risks.

The meeting, known as the National Financial Work Conference, is held every five years and sets broad policy goals for regulators. It is expected to discuss topics such as fintech regulation, green finance, financial opening-up and systemic risk prevention.