The UK’s private sector has suffered a sharp decline in activity in September, raising the risk of a recession as firms cut jobs and face rising costs of living and borrowing. The latest survey from S&P Global and the Chartered Institute of Procurement and Supply (Cips) showed the steepest drop in output since the global financial crisis in 2009, excluding the pandemic lockdowns.

Bank of England pauses interest rate hikes

The survey data, which was seen by the Bank of England before its decision to hold interest rates at 5.25% on Thursday, showed that both the service sector and manufacturing output contracted in September. The Bank of England had raised interest rates 14 times since 2021 to curb inflation, which reached 6.8% in August, the highest level since 1992.

However, the central bank paused its tightening cycle amid growing concerns over the economic outlook, as higher borrowing costs and the cost of living crisis weigh on consumer demand and business confidence. The Bank of England also warned that supply chain disruptions and labour shortages could persist for longer than expected, adding to the inflationary pressures.

Private sector activity falls to lowest level since 2009

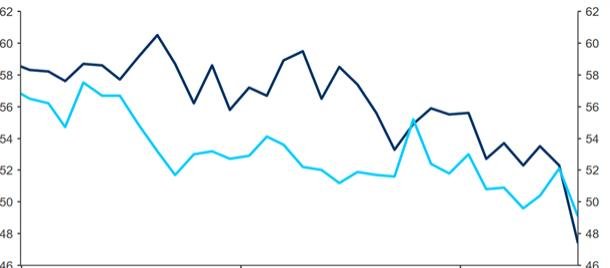

The S&P Global/Cips composite output index, which measures the combined performance of the service sector and manufacturing, fell from 48.6 in August to 46.8 in September, well below the 50 mark that separates growth from contraction. This was the lowest reading since March 2009, apart from the pandemic lockdown months.

The survey also showed that total new work in the private sector fell for the third month in a row, as firms reported lower demand from both domestic and overseas customers. The decline in new orders was the sharpest since April 2020, when the UK was under strict lockdown measures.

The private sector also reduced its workforce at the fastest pace since May 2020, as firms struggled to cope with rising costs and lower revenues. The survey indicated that input prices rose at a record rate in September, driven by higher costs of raw materials, energy, fuel and wages. Output prices also increased at a near-record pace, as firms tried to pass on some of the cost burden to their customers.

Recession risk increases as economic outlook worsens

The disappointing survey results for September suggest that the UK economy is shrinking at a quarterly rate of about 0.4%, according to Chris Williamson, the chief business economist at S&P Global market intelligence. He said that a recession was looking increasingly likely in the UK, as the downturn in September was the steepest since the height of the global financial crisis.

He added that the UK’s economic situation was deteriorating rapidly, as higher interest rates and cost of living pressures were hurting both consumers and businesses. He also said that the ongoing supply chain disruptions and labour shortages were hampering production and delivery of goods and services.

He warned that unless these challenges were resolved soon, the UK economy could face a prolonged period of stagnation or contraction, with inflation remaining high and unemployment rising.