Natural disasters can wreak havoc on communities, leaving people without homes and possessions, and causing hundreds of billions of dollars in damage. From hurricanes to wildfires, some of the most costly natural disasters can cause devastating destruction and can be difficult to plan for and recover from. Planning ahead and understanding the financial impact of natural disasters is essential, and insurance can be a key tool in helping to mitigate the financial burden of these events.

In this article, we will discuss the most costly natural disasters and how insurance can help in planning for the worst. We will look at the impact of different types of disasters, the importance of planning ahead, and the role that insurance can play in helping to protect individuals and families from the financial hardships caused by these events. We will also discuss the importance of understanding the various types of insurance available and the steps that can be taken to make sure that you and your family are properly protected from the financial losses that can result from natural disasters. By understanding the potential impact of natural disasters, and by having adequate insurance protection in place, individuals and families can be better prepared to face the challenges associated with natural disasters.

The Most Costly Natural Disasters of All Time

Natural disasters have caused devastation and destruction across the globe, leaving behind a trail of destruction and death. When it comes to the costliest natural disasters in history, here are the top ten:

Hurricane Katrina (2005): One of the deadliest and costliest hurricanes in history, it caused an estimated $108 billion in damage along the Gulf Coast of the United States. It was the result of a combination of record-breaking storm surges and strong winds, which caused extensive flooding of New Orleans and other areas. The storm resulted in the death of over 1,800 people and left thousands homeless.

2011 Japan Earthquake and Tsunami: The magnitude 9.0 earthquake and subsequent tsunami caused an estimated $235 billion in damage and left over 15,000 people dead. The quake triggered a nuclear meltdown in Fukushima and caused widespread destruction throughout northern Japan, including the destruction of entire towns and villages.

2004 Indian Ocean Earthquake and Tsunami: This magnitude 9.1 earthquake triggered a massive tsunami that left over 230,000 people dead and caused an estimated $14 billion in damage. It was one of the deadliest natural disasters in history, with the death toll spreading across fourteen countries.

2008 Sichuan Earthquake: With an estimated death toll of nearly 70,000 people, this 7.9 magnitude earthquake caused an estimated $86 billion in damage. The quake destroyed entire towns in the Sichuan province of China, leaving many homeless and without access to basic services.

2001 Gujarat Earthquake: This 7.7 magnitude earthquake struck western India in January 2001, causing an estimated $6.7 billion in damage and killing over 20,000 people. The quake caused widespread destruction, with entire villages being wiped out.

2010 Haiti Earthquake: This magnitude 7.0 earthquake killed over 220,000 people and left over 1.5 million homeless. The quake caused an estimated $14 billion in damage, making it one of the most devastating natural disasters in history.

Cyclone Nargis (2008): This category four cyclone struck Myanmar in 2008, causing an estimated $10 billion in damage and killing over 138,000 people. The storm caused widespread destruction, with entire villages and towns being destroyed and millions of people left homeless.

2010 Chile Earthquake: This magnitude 8.8 earthquake struck Chile in 2010, killing over 500 people and causing an estimated $30 billion in damage. The quake caused widespread destruction throughout the country, with entire towns and villages being wiped out.

1953 East Sea Tsunami: This tsunami struck Japan in 1953, killing over 5,000 people and causing an estimated $500 million in damage. The tsunami was triggered by an earthquake with a magnitude of 8.1 and caused widespread destruction in the area, with entire villages being swept away.

1976 Tangshan Earthquake: This magnitude 7.5 earthquake struck China in 1976, killing over 242,000 people and causing an estimated $10 billion in damage. The quake caused widespread destruction throughout the region, with entire towns and villages being wiped out.

These are some of the most costly natural disasters in history, with each causing extensive destruction and death. The death toll and cost of the disasters varies greatly, but one thing remains the same: the devastation caused by natural disasters can be immense.

The Role of Insurance in Natural Disaster Prevention and Recovery

Insurance has become an increasingly important factor in helping people and businesses prepare for and recover from natural disasters. There are a variety of types of insurance available to protect people from different types of disasters.

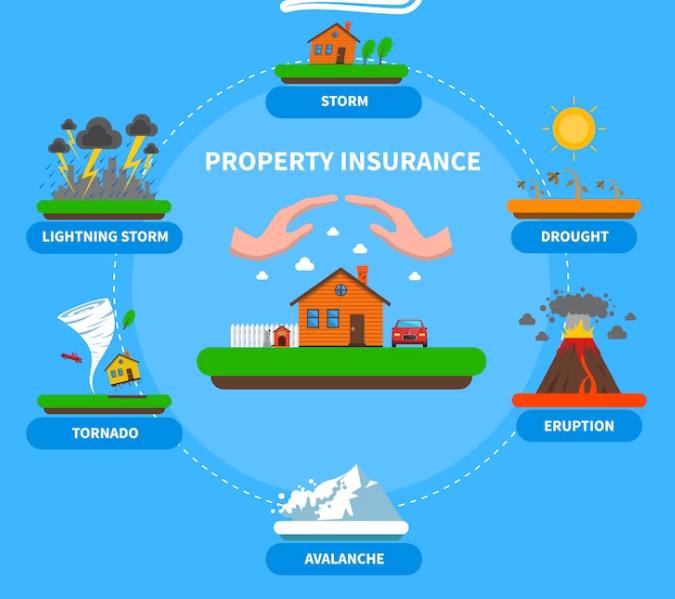

Property Insurance: Property insurance is a form of insurance that covers losses and damages to a person’s property due to natural disasters. This type of insurance typically covers losses caused by floods, hurricanes, wildfires, and tornadoes. Property insurance can also be used to protect a person’s home and belongings, as well as their business assets.

Flood Insurance: Flood insurance is a type of insurance that covers losses and damages due to flooding. This type of insurance typically covers losses caused by overflowing rivers, overflowing lakes, and other sources of flooding. Flood insurance is an important factor in helping people in flood-prone areas prepare for and recover from flooding.

Earthquake Insurance: Earthquake insurance is a type of insurance that covers losses and damages due to earthquakes. This type of insurance typically covers losses caused by shaking and other earthquake-related activities. Earthquake insurance can be a valuable tool for people living in earthquake-prone areas, helping them to prepare for and recover from an earthquake.

Case Studies: There are numerous cases where insurance has helped individuals and businesses recover from natural disasters. For example, after the 2011 earthquake and tsunami in Japan, property insurance helped many people to rebuild their homes and businesses. Similarly, after Hurricane Katrina in 2005, flood insurance helped many people to rebuild their homes and businesses. These case studies demonstrate how insurance can be a valuable tool in helping individuals and businesses prepare for and recover from natural disasters.

Encouraging Preparedness and Risk Mitigation: Insurance can also be used to encourage preparedness and risk mitigation. For example, some insurance policies require people to take certain steps to mitigate their risk of being affected by a natural disaster, such as having a generator on hand or installing storm shutters on windows. By requiring people to take these steps, insurance companies can help to reduce the risk of damage due to natural disasters.

How to Choose the Right Insurance Coverage for Your Needs

Choosing the right insurance coverage for your needs can be tricky, especially when it comes to natural disasters. It is important to consider several factors when selecting a policy, such as location, risk factors, and budget. To help you make the best decision, here is a guide on how to choose the right insurance coverage for your needs.

Overview of Factors: When choosing insurance coverage for natural disasters, it is important to take into consideration several factors. Location is a key factor as certain areas are more prone to natural disasters than others, so it is important to be aware of the risks and potential impacts. Risk factors should also be considered, such as the type and amount of coverage needed and the likelihood of a natural disaster occurring in the area. Lastly, it is important to factor in budget, as the cost of insurance policies can vary greatly depending on the coverage provided.

Comparing Policies and Companies: When comparing different insurance policies and companies, it is important to look at the coverage they provide and the cost of the policy. Make sure to read the policy document carefully to understand the coverage and any exclusions or limits on the coverage. Additionally, research the company to ensure they are reputable and have a good track record of providing adequate coverage and compensation.

Working with Insurance Companies: Once you have chosen the right insurance policy for your needs, it is important to work with the insurance company to ensure you receive adequate coverage and compensation in the event of a natural disaster. Make sure to keep all policy documents up to date and contact your insurance company if any changes occur in the policy or if you need to make a claim. Additionally, ensure that the insurance company knows about any changes in your location or risk factors, as these can affect the coverage and compensation you receive.

By following these tips, you can make sure that you have the right insurance coverage for your needs and are adequately protected in the event of a natural disaster.

Planning for Natural Disasters: Best Practices

Creating a natural disaster preparedness plan for yourself, your family, or your business is critical in order to ensure the safety of everyone involved. It is important to research the natural disasters that are common in your area and to understand what steps should be taken if one of these disasters were to occur. Some key steps that should be included in your plan are stocking up on emergency supplies, knowing evacuation routes, and having an emergency contact list in the event of a disaster.

It is also important to stay informed about the weather and any natural disaster alerts that may be issued in your area. Make sure to monitor news reports and other sources of information to stay up to date on any changing weather or emergency situations. Additionally, if the situation calls for it, make sure to evacuate safely. Have a plan in place for where you will go and how you will get there, and be sure to avoid any areas that are likely to be impacted by the disaster.

Finally, it is important to protect your property and assets from damage caused by natural disasters. Make sure to secure any outdoor items that can be moved, such as patio furniture or outdoor decorations. Additionally, invest in protective materials such as storm shutters and window coverings to protect your home from high winds and debris. If you own a business, make sure to backup any important data and documents, and consider investing in flood insurance to protect against any water damage.

Making a plan for natural disasters is essential to ensure the safety of yourself, your family, and your business. Make sure to research the natural disasters that are common in your area, stay informed about weather and natural disaster alerts, evacuate safely if necessary, and protect your property and assets from damage caused by the disaster. With the right plan in place, you can be better prepared to handle any natural disasters that may come your way.

Conclusion

The most costly natural disasters can have devastating impacts on individuals, communities and businesses. Whether it’s an earthquake, hurricane, or wildfire, being prepared for these disasters is essential. Insurance can play a crucial role in minimizing the financial losses associated with these events, and proper insurance coverage should be a priority for all individuals and businesses.

It is important to continue to be proactive and take precautionary steps to help reduce the effects of natural disasters. In addition to having adequate insurance coverage, preventive measures such as creating emergency plans, investing in loss prevention measures, and educating individuals on the risks posed by natural disasters should be taken.

Natural disasters can have a devastating impact on individuals, communities and businesses. It is essential to plan ahead and have adequate insurance coverage in order to minimize the financial losses associated with these events. There is also a need for continued efforts to improve natural disaster prevention, preparedness, and recovery in order to reduce the effects of these disasters. By taking the necessary steps to prepare for the worst, individuals, communities and businesses can ensure they are better able to cope with and recover from natural disasters.

FAQs – How Insurance Can Help: Planning for the Worst

1. What are the most expensive natural disasters?

The most expensive natural disasters include floods, hurricanes, earthquakes, and tornadoes. Hurricanes Harvey, Irma, and Maria, which hit the US in 2017, caused an estimated $265 billion in damages combined. The 2011 Tōhoku earthquake and tsunami in Japan is the most expensive natural disaster to date, with a total estimated cost of $235 billion.

2. How can insurance help with natural disasters?

Insurance can help cover the costs of repairs or replacements for property, infrastructure, and other assets damaged by a natural disaster. Insurance can also help cover the costs of medical care, lost wages, and other expenses related to the disaster.

3. What kind of insurance covers natural disasters?

Homeowners and renters insurance can provide coverage for many natural disasters, including floods, wind and hail damage, and fire damage. Earthquake and flood insurance may also be available in some areas.

4. What should I do to prepare for a natural disaster?

To prepare for a natural disaster, it’s important to ensure your home and property are adequately insured against the most likely risks. It’s also important to create an emergency plan and stock up on supplies, such as food, water, and other essentials.

5. How can I find the best insurance for natural disasters?

To find the best insurance for natural disasters, compare coverage options from different insurers and make sure the policy covers the disasters most likely to occur in your area. Also, make sure to read the fine print and understand the exclusions and limitations of the coverage.

6. What should I do if my property is damaged by a natural disaster?

If your property is damaged by a natural disaster, contact your insurance company right away to start a claim. Be sure to take pictures of the damage and keep all documents related to the claim. Also, make sure to stay in contact with your insurer throughout the claims process.

7. How much does insurance cost for natural disasters?

The cost of insurance for natural disasters depends on a variety of factors, including the location of the property, the type of coverage, and the level of risk. Generally, the higher the risk, the higher the premium.

8. What happens if I don’t have insurance for a natural disaster?

If you don’t have insurance for a natural disaster, you may be responsible for covering the costs of repairs or replacements for your property and other assets damaged by the disaster. This can be a costly expense and may be difficult to manage without insurance.

9. What is the best way to get insurance for a natural disaster?

The best way to get insurance for a natural disaster is to shop around and compare coverage options from different insurers. Make sure the policy covers the disasters most likely to occur in your area, and read the fine print to understand the exclusions and limitations of the coverage.

10. What should I do if my insurer denies my claim for a natural disaster?

If your insurer denies your claim for a natural disaster, contact them to ask why the claim was denied. You can also contact your state insurance department to ask for assistance in resolving the dispute.