China’s consumer prices fell for the first time in 11 years in July, as the COVID-19 pandemic dampened consumer demand and lowered food prices. The consumer price index (CPI), a main gauge of inflation, dropped 0.5% year-on-year in July, after rising 1.1% in June, according to the National Bureau of Statistics (NBS). This was the first negative CPI reading since October 2012, when it fell 0.1%.

The main driver of the CPI decline was food prices, which fell 3.7% year-on-year in July, after rising 0.2% in June. Food prices account for nearly one-third of the CPI basket in China. The NBS attributed the drop in food prices to a high base of comparison last year, when pork prices soared due to the African swine fever outbreak, and to a recovery in pork supply and a decline in demand this year.

The core CPI, which excludes food and energy prices, rose 1.3% year-on-year in July, unchanged from June. This indicates that the underlying inflation pressure remains subdued, as the economic recovery from the pandemic remains uneven and uncertain.

China’s deflationary pressure hurts low-end restaurants and consumers

The deflationary pressure in China is hurting low-end restaurants and consumers, who are facing a price war and a lack of spending power. Low-end restaurants, such as Nanchengxiang, a chain that offers a breakfast buffet for 3 yuan ($0.40), are slashing their prices to attract customers who are reluctant to spend amid the pandemic. However, this strategy may not be sustainable, as it squeezes their profit margins and increases their competition with other restaurants.

Consumers, especially low-income and elderly ones, are also suffering from deflation, as their wages and pensions stagnate or decline, while their living costs remain high. Some consumers are resorting to bargain hunting or cutting back on their spending, which further reduces their consumption and confidence.

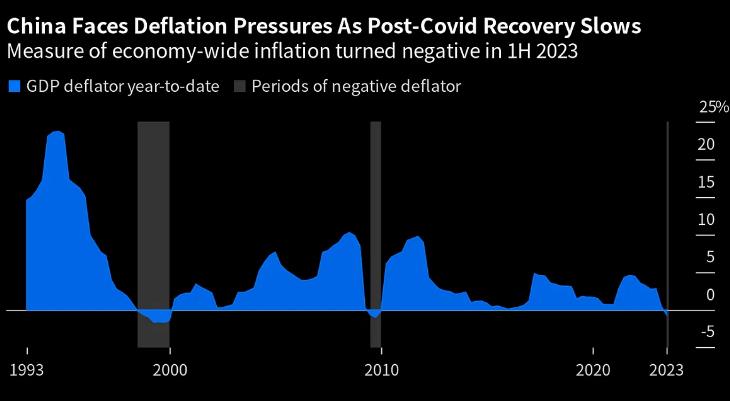

Deflation, if prolonged, can have negative consequences for the economy, as it lowers business profits, reduces investment, increases debt burdens, and weakens monetary policy effectiveness. Deflation can also create a vicious cycle of falling prices and demand, as witnessed by Japan in the 1990s.

China’s policymakers may need to take more stimulus measures to boost inflation

China’s policymakers may need to take more stimulus measures to boost inflation and support the economic recovery from the pandemic. The People’s Bank of China (PBOC), the central bank, has already cut its benchmark lending rate by 30 basis points and its reserve requirement ratio by 100 basis points since March 2020. However, these measures have not been enough to stimulate credit growth and consumer spending.

Some analysts suggest that the PBOC may need to cut its policy rates further or increase its direct lending to small businesses and local governments. The PBOC may also need to adopt more unconventional tools, such as quantitative easing or negative interest rates, if deflation persists or worsens.

The Chinese government may also need to increase its fiscal spending and tax cuts to boost aggregate demand and income. The government may also need to implement more structural reforms, such as improving social security, health care, and education systems, to enhance consumer confidence and welfare.