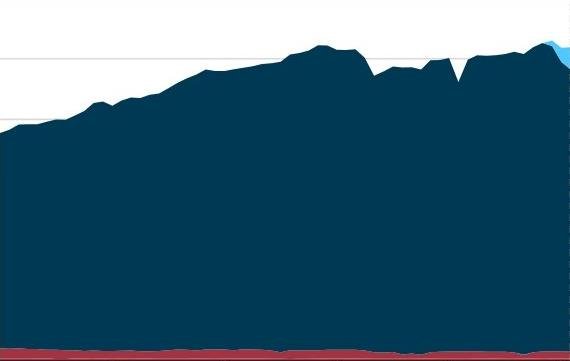

Natural gas price (XNG/USD) recovered some of its losses on Friday after hitting a two-week low of $2.61 per mmBtu on Thursday. The energy commodity bounced off the 100-day exponential moving average (EMA) around $2.76 and closed the week at $2.81, up 1.59% on the day.

The rebound was driven by a combination of factors, including a steady reading of the relative strength index (RSI), a weaker US dollar, and a positive demand outlook for the coming weeks.

Steady RSI Suggests Further Recovery

The RSI, a technical indicator that measures the momentum of price movements, remained stable around 50 on the daily chart, indicating a balanced market sentiment. A reading above 50 signals bullish momentum, while a reading below 50 signals bearish momentum.

A steady RSI suggests that natural gas price may have found some support at the 100-day EMA and could extend its recovery in the near term. However, the commodity faces some resistance from a downward-sloping trendline that connects the highs of August 10 and August 16, around $2.82 at the time of writing.

A break above this trendline could open the door for further gains towards the $3.00 level, where natural gas price encountered strong selling pressure in early August. On the other hand, a break below the 100-day EMA could trigger a fresh wave of selling and push the price towards the $2.60 level, where an ascending trendline from June provides some support.

US Dollar and Treasury Yields Retreat

Another factor that supported natural gas price on Friday was the weakness of the US dollar and the US Treasury bond yields, which tend to have an inverse relationship with commodities priced in the greenback.

The US dollar index (DXY), which measures the strength of the dollar against a basket of six major currencies, fell 0.27% to 93.36 on Friday, retreating from a nine-month high of 93.73 reached on Wednesday. The decline was mainly due to a disappointing retail sales report that showed a 1.1% drop in July, worse than the expected 0.3% decline.

The US Treasury bond yields also fell on Friday, as investors sought safe-haven assets amid rising concerns over the delta variant of COVID-19 and its impact on global economic recovery. The yield on the benchmark 10-year Treasury note dropped to 1.26%, down from 1.34% on Thursday.

A lower US dollar and lower bond yields make natural gas and other commodities cheaper and more attractive for foreign buyers, boosting their demand and price.

Demand Outlook Remains Positive

The demand outlook for natural gas also remained positive on Friday, as forecasts for hot weather and higher cooling demand in the US and Europe offset expectations for lower demand in Asia due to lockdowns and monsoon rains.

According to Refinitiv data, US power generation demand is expected to rise from an average of 90.8 billion cubic feet per day (bcfd) this week to 92.4 bcfd next week, as temperatures are expected to remain above normal across most parts of the country.

In Europe, power generation demand is also expected to increase from an average of 18.9 bcfd this week to 19.6 bcfd next week, as heat waves hit several countries such as Spain, Italy, and Greece.

Meanwhile, liquefied natural gas (LNG) exports from the US are expected to remain high, as global LNG prices are still at elevated levels due to tight supply and strong demand from Europe and Latin America.

According to Refinitiv data, US LNG exports averaged 10.7 bcfd so far in August, up from 10.5 bcfd in July and 3.5 bcfd in August last year.

Overall, natural gas price managed to pare some of its weekly losses on Friday, as it bounced off a key technical level and benefited from a weaker US dollar and a positive demand outlook. However, the commodity still faces some upside hurdles and downside risks that could influence its direction in the coming days.