Compound interest is a critical concept in finance that refers to the process of earning interest on both the initial principal and the accumulated interest from previous periods. Unlike simple interest, which is calculated solely on the principal amount, compound interest allows for exponential growth of an investment over time. This is because each period’s interest is added to the principal, resulting in a larger amount on which interest is calculated in subsequent periods. Understanding how to calculate and utilize compound interest can significantly enhance one’s ability to grow investments more efficiently.

Key Takeaways:

- Compound Interest: Compound interest is the interest calculated on both the initial principal and the accumulated interest from previous periods, unlike simple interest which is only on the initial principal.

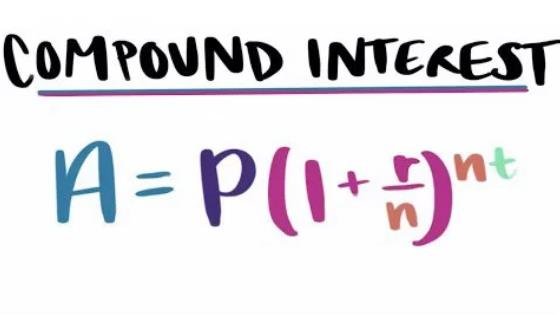

- Formula for Compound Interest: The formula to calculate compound interest is:

𝐴=𝑃(1+𝑟𝑛)𝑛𝑡Where 𝐴 is the final amount, 𝑃 is the principal, 𝑟 is the annual interest rate, 𝑛 is the number of times interest is compounded per year, and 𝑡 is the time in years.

- Example Calculation: For a $10,000 investment at a 5% annual rate compounded monthly for 3 years, the final amount is $11,616.89, with $1,616.89 being the compound interest earned.

What is Compound Interest?

Compound interest is the interest that is calculated on the initial principal amount and the accumulated interest of previous periods. In other words, compound interest is the interest on interest. Compound interest is different from simple interest, where interest is only calculated on the initial principal amount. Compound interest allows the principal amount to grow faster than simple interest, as more interest is added to the principal over time.

How to Calculate Compound Interest?

To calculate compound interest, we need to know the following variables:

- P: The initial principal amount or the original amount invested

- r: The annual interest rate expressed as a decimal

- n: The number of times the interest is compounded per year

- t: The time period in years

The formula for compound interest is:

A = P ( 1 + r n) n t

Where A is the final amount or the future value of the investment.

For example, suppose you invest $10,000 at an annual interest rate of 5%, compounded monthly, for 3 years. To find the final amount, you can use the formula as follows:

A = 10,000 ( 1 + 0.05 12) 12 × 3

A = 10,000 ( 1.0042) 36

A = 11,616.89

Therefore, the final amount after 3 years is $11,616.89.

How to Find the Compound Interest?

To find the compound interest, we need to subtract the initial principal amount from the final amount. In other words,

Compound Interest = A – P

Using the same example as above, we can find the compound interest as follows:

Compound Interest = 11,616.89 – 10,000

Compound Interest = 1,616.89

Therefore, the compound interest earned after 3 years is $1,616.89.

How to Use a Compound Interest Calculator?

If you don’t want to do the calculations manually, you can use a compound interest calculator online. There are many websites that offer free and easy-to-use compound interest calculators, such as this one. To use a compound interest calculator, you just need to enter the values of P, r, n, and t, and click on calculate. The calculator will show you the final amount and the compound interest for your investment.

For example, using the calculator with the same values as above, we get:

Final Amount: $11,616.89

Compound Interest: $1,616.89

You can also use the calculator to change any of the variables and see how they affect your investment outcome.

Why is Compound Interest Important?

Compound interest is important because it shows how your money can grow over time with regular reinvestment of interest. Compound interest can help you achieve your financial goals faster and easier than simple interest.

Compound interest also illustrates the power of compounding, which is one of the most fundamental principles of investing. Compounding means that a small amount of money invested today can grow into a large amount of money in the future, thanks to the effect of compound interest.

For example, if you invest $100 at an annual interest rate of 10%, compounded annually, for 10 years, you will have $259.37 at the end of 10 years. However, if you invest $100 at an annual interest rate of 10%, compounded annually, for 20 years, you will have $672.75 at the end of 20 years. That’s more than double what you would have after 10 years.

Therefore, compound interest can help you make more money from your investments over time.

Conclusion

In conclusion, compound interest is a powerful financial tool that can significantly boost the growth of your investments over time. By reinvesting the interest earned, you allow your principal to increase at a faster rate compared to simple interest. Utilizing the compound interest formula or online calculators can help you understand how different variables affect your investment outcome. Recognizing the importance of compound interest and incorporating it into your financial planning can help you achieve your long-term financial goals more effectively, demonstrating the true potential of compounded growth.