Tight smiles, big cheques and a raft of new deals in Washington have elevated Riyadh — and dimmed Jerusalem’s leverage over Saudi normalization. The crown prince left the White House with advances that could widen the gap between U.S.–Saudi ties and any near-term Israel–Saudi breakthrough.

A Washington Welcome with Real Teeth

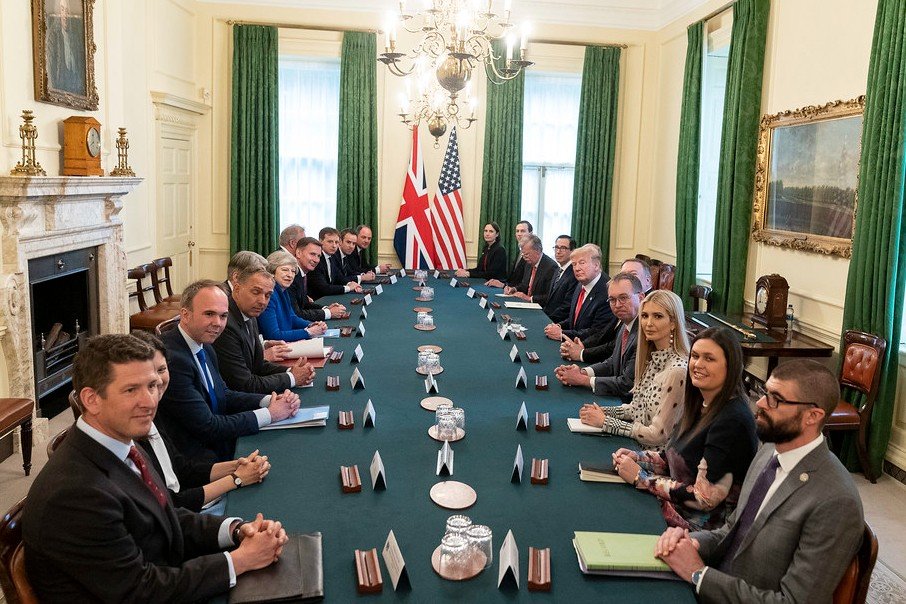

Mohammed bin Salman arrived in Washington to fanfare that went beyond protocol. He and President Donald Trump signed a Strategic Defense Agreement and the administration designated Saudi Arabia a major non-NATO ally while moving ahead on possible F-35 sales — shifts that materially bolster Riyadh’s security position.

That matters because the Abraham Accords project has always hinged on tradeoffs: security guarantees and political cover in return for Riyadh taking the diplomatic step to normalize with Israel. Now the United States has unilaterally sweetened the pot for Saudi Arabia. The bargaining math just changed.

A quick beat: this isn’t just about weapons. It’s about stature.

Deals on tech, nuclear and jets — and what Israel loses

The visit produced a flurry of commercial and tech headlines. Saudi-backed AI group Humain signed major partnerships and announced joint ventures with global firms — AMD, Cisco, Qualcomm and others — aimed at building large-scale data centers and regional AI capacity. That project, and similar deals, reduce Riyadh’s reliance on Israeli tech as a shortcut to regional clout.

Civil nuclear cooperation was also spotlighted. Washington framed the agreement as closely guarded by non-proliferation commitments, yet even the promise of long-term nuclear partnership raises strategic questions for Israel if the relationship deepens.

• The F-35 announcement — and talk of future sales — was the headline that made many in Jerusalem wince. The jets would be the first fifth-generation fighters sold to an Arab state, a move Trump argued could be managed while preserving Israel’s qualitative military edge. Critics remain skeptical.

| Item | What it signals | Why it matters |

|---|---|---|

| Strategic Defense Agreement | Deeper U.S.–Saudi military cooperation | Less U.S. leverage needed from Israel as a price for support. |

| Major Non-NATO Ally status | Political-military elevation | Opens access to U.S. military tools and training. |

| AI and civil nuclear deals | Economic and technological build-up | Alternative sources for Riyadh’s security and prestige needs. |

A one-line pause here.

Israel is still indispensable in many technical domains, but Washington’s package gives Riyadh plenty of alternatives.

Public opinion and the Palestinian question — Saudi caution

The crown prince repeated his public line: Saudi normalization would require a credible path to Palestinian statehood. That condition has not evaporated. Saudi leaders face a domestic audience and regional capitals that would object to any move perceived as abandoning Palestinian aspirations.

Short sentence here.

After two years of war in Gaza, emotions run raw, diplomats say. The Saudi street matters; Riyadh cannot simply wave away public opinion and accept a deal that will be seen as rewarding Israeli military posture. So even as Washington rolls out the red carpet, the kingdom’s political calculus looks tougher, not easier.

One more line for breathing.

And let’s be blunt — even if American guarantees and sophisticated arms appear, Saudi rulers might still demand a clearer and more binding Israeli political concession than Jerusalem is willing to give right now.

A tougher price for normalization — diplomacy in a new key

So where does this leave Israel? In the short term, Jerusalem has fewer cards to trade. Riyadh’s elevation in Washington reduces the urgency for the U.S. to lean on Saudi leaders to normalize as a favor to Israel. In effect, Saudi gains stiffen the kingdom’s bargaining posture.

Quick one-sentence break.

For Israel, that could mean pressing the U.S. for deeper, Senate-backed guarantees or a formalized security compact if it hopes to keep Riyadh’s path to normalization open without conceding major political ground. Some analysts suggest only a Senate-ratified mutual defense treaty or a very explicit 20-year memorandum would offset Riyadh’s new leverage.

Final short note.

But history shows balances can swing. U.S. administrations change. Investments and deals can fray. Trump’s warmth toward MBS is powerful today; it might be less decisive three years hence. Meanwhile, Israel still retains unmatched military and intelligence capabilities and a high-tech sector that Washington values — assets that could reassert Jerusalem’s importance over time.