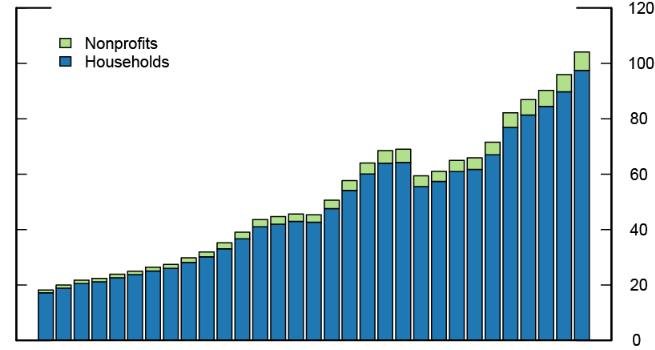

According to the latest data from the Federal Reserve Bank of St. Louis, the households and nonprofit organizations (NPOs) in the United States held a record high of $4,513.208 billion in checkable deposits and currency assets as of the first quarter of 2023. This is an increase of $5.438 billion from the previous quarter, and a whopping $1,122.374 billion from the same quarter last year.

Checkable deposits and currency assets are the most liquid forms of money that can be used for transactions and payments. They include demand deposits, negotiable order of withdrawal (NOW) accounts, automatic transfer service (ATS) accounts, credit union share draft accounts, and currency.

The surge in checkable deposits and currency assets reflects the changing behavior of consumers and businesses amid the COVID-19 pandemic and its aftermath. As the economy faced uncertainty and volatility, many people preferred to hold more cash and deposits as a precautionary measure. Moreover, the stimulus checks and relief payments from the government also boosted the liquidity of households and NPOs.

Total Time and Savings Deposits Also Reach New Peak

In addition to checkable deposits and currency assets, the households and NPOs in the U.S. also increased their holdings of total time and savings deposits to a new high of $14,906.057 billion in the first quarter of 2023. This is an increase of $155.792 billion from the previous quarter, and a remarkable $2,515.223 billion from the same quarter last year.

Total time and savings deposits are less liquid than checkable deposits and currency assets, but they usually offer higher interest rates. They include time deposits, money market deposit accounts (MMDAs), savings deposits (including passbook accounts), and small-denomination time deposits (including certificates of deposit or CDs).

The growth in total time and savings deposits indicates that households and NPOs are saving more and spending less due to the pandemic-induced recession and reduced income opportunities. Furthermore, the low interest rate environment and the limited investment options also encouraged people to park their money in safe and insured deposits.

Implications for the Economy and Monetary Policy

The unprecedented rise in checkable deposits and currency assets, as well as total time and savings deposits, has significant implications for the economy and monetary policy. On one hand, it shows that households and NPOs have ample liquidity and purchasing power that can support the economic recovery once the pandemic is over. On the other hand, it also poses a risk of inflationary pressures if the excess money supply is not properly managed by the central bank.

The Federal Reserve has been implementing an accommodative monetary policy stance since the onset of the COVID-19 crisis, by cutting the federal funds rate to near zero, expanding its balance sheet through quantitative easing, and providing forward guidance on its future actions. The Fed has also adopted a new framework that allows inflation to run moderately above its 2% target for some time to achieve maximum employment.

However, as the economy rebounds from the pandemic shock, some economists and market participants are concerned that the Fed may be behind the curve in tightening its policy stance to prevent overheating and runaway inflation. The recent data on consumer price index (CPI) showed that inflation rose to 4.2% year-over-year in April 2023, the highest since September 2008. The Fed has maintained that this spike is transitory and largely driven by base effects and supply bottlenecks, but some analysts are skeptical about this view.

The Fed will have to balance its dual mandate of price stability and full employment while monitoring the dynamics of money supply and demand in the post-pandemic era. The Fed will also have to communicate clearly and effectively with the public about its policy intentions and actions to avoid any confusion or misunderstanding that could destabilize the financial markets.