Surge in Visitors from Asia and Europe Fuels Growth Despite June Dip

Tourism is back in Jordan — and stronger than many expected. The country pulled in $3.67 billion in tourism revenue during the first half of 2025, up 11.9% from the same period last year, according to the Central Bank of Jordan. The jump came even as June brought a slight hiccup, with monthly receipts slipping 3.7%.

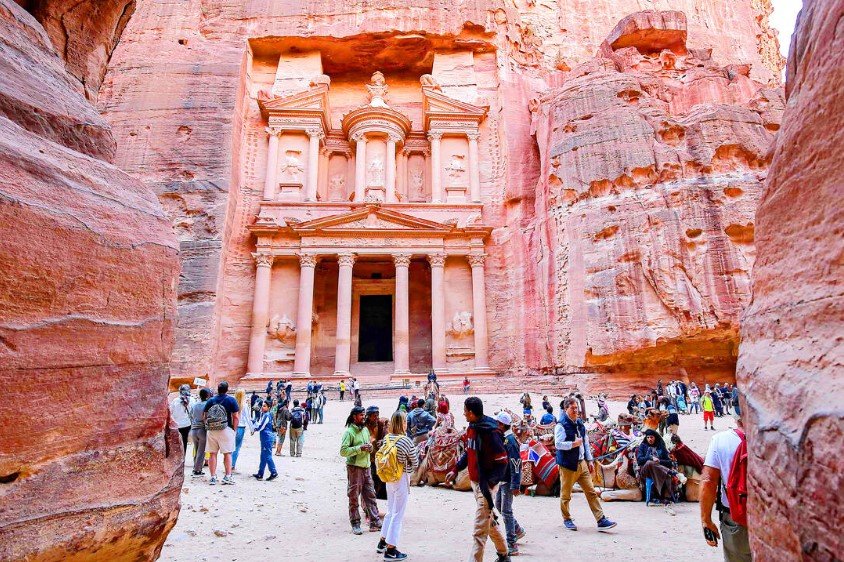

That didn’t stop Petra from welcoming its crowds, or Amman’s hotels from filling up. And it hasn’t slowed the growing stream of tourists from Asia, Europe, and the Americas.

Asian and European Travelers Lead the Surge

While Arab visitors remain the backbone of Jordan’s tourism numbers, it’s tourists from farther afield who are driving the biggest revenue spikes.

According to figures shared by state-run Petra news agency, revenue from Asian tourists soared by 42.9% in the first half of the year. European visitors weren’t far behind, with a 35.6% increase. Even U.S. travelers — typically fewer in number — boosted spending by 25.8%.

One paragraph, one stat — just to let it sink in.

Meanwhile, Arab tourist revenues grew more modestly at 11.5%, but still played a crucial role in the kingdom’s hospitality scene. The most surprising twist? Revenue from “other nationalities” spiked a whopping 43.0%.

The only group that went the other way was Jordanian expatriates, whose inbound tourism spending dipped by 0.8% compared to last year.

A Closer Look at the Spending Breakdown

It’s not just foreign tourists spending more. Jordanians themselves are feeling the urge to travel — and spend.

In the first six months of 2025, Jordanians shelled out nearly $1 billion on outbound tourism, up 3.3% year-on-year. But June told a different story. That month alone saw outbound spending plunge 22.7% to $195.6 million, likely linked to flight cost spikes and school exams.

To put this in context:

| Metric | H1 2025 Amount | YoY Change |

|---|---|---|

| Total Tourism Revenue | $3.67 billion | +11.9% |

| Revenue from Asian Tourists | — | +42.9% |

| Revenue from European Tourists | — | +35.6% |

| Outbound Tourism Spending (Jordanians) | $999.7 million | +3.3% |

| June Tourism Revenue | $619.2 million | -3.7% |

| June Outbound Spending | $195.6 million | -22.7% |

One official from Jordan’s Ministry of Tourism, speaking on background, attributed the dip in June to “seasonal variability” and “a slight cooling effect” from regional tensions, particularly involving neighboring Syria and Israel.

Jordan Stays Resilient While the Region Sizzles

The tourism revival is not unique to Jordan — but it’s especially significant for a country that depends on it as a top foreign currency earner.

In May, the World Travel and Tourism Council revealed that Middle East tourism added $341.9 billion to GDP in 2024, supporting 7.3 million jobs. The region’s 2025 outlook? A projected $367.3 billion in GDP contribution and 7.7 million jobs.

Saudi Arabia was the star performer in 2024, with tourism revenues soaring 148%, fueled by mega-events and religious travel. Oman, the UAE, and Qatar have also seen double-digit gains in tourist arrivals thanks to slick marketing and new visa policies.

Still, Jordan’s gains are particularly meaningful — given its smaller economy and ongoing efforts to reposition itself beyond heritage tourism. It’s not just about Petra and Wadi Rum anymore. Wellness retreats in the Dead Sea, culinary tours, and ecotourism packages are pulling new types of travelers.

A Bump in June — But No Panic Yet

That 3.7% drop in June revenues raised some eyebrows.

It’s the first monthly decline since early 2023, and came just as regional tensions — particularly in southern Syria and northern Israel — flared up again. Some tour operators temporarily rerouted visitors away from northern Jordan.

But industry insiders insist it’s a blip.

“I wouldn’t call this a downturn,” said Diala Haddadin, who runs a boutique hotel in Madaba. “People are still booking. Some just delayed to July or August. We’ve had a few nervous calls, but no wave of cancellations.”

Others agree. Airline bookings from Europe to Jordan for August and September remain strong, especially from Italy, Spain, and Germany.

One sentence. Just a breather.

The Numbers That Matter Most for Amman

For Jordanian officials, the revenue uptick means more than just a budget boost.

Tourism is a major employer — especially for youth and women — and it also supports a wide array of microbusinesses across the country, from Bedouin guides to rural artisans. Every dinar spent by a foreigner creates ripple effects across sectors like agriculture, transportation, and food.

Here’s what Jordan is banking on going forward:

-

Expanded charter flight deals with Asian and Eastern European countries

-

Streamlined visa processes for group tours and solo travelers

-

New investments in desert camps, eco-lodges, and wellness resorts

The hope is to keep diversifying away from traditional European markets — and toward high-growth regions like South Asia and Central Asia.

Can Jordan Keep the Momentum Going?

The first half of 2025 was good. But the second half holds the real test.

Political uncertainty, fuel prices, and global inflation could still weigh on travel budgets. Jordan also faces stiff competition — especially from destinations like Egypt, which is aggressively pricing Red Sea vacation packages.

But there’s optimism on the ground. The Ministry of Tourism is prepping a new fall campaign targeting Gen Z travelers on TikTok and Instagram. There’s also talk of hosting a regional culture summit in Amman this November, aiming to draw media and influencers from across the Arab world.

Petra may still be the icon — but it’s Jordan’s adaptability that’s quietly stealing the spotlight.