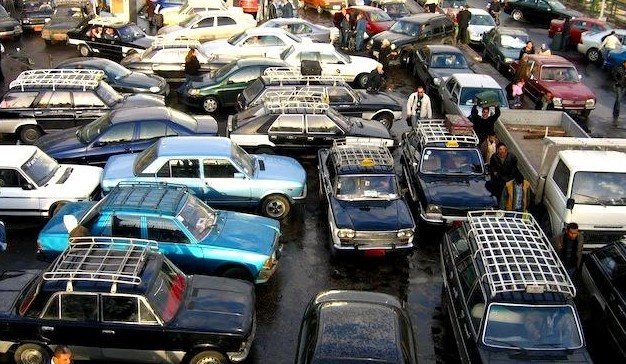

Egypt’s automotive market is exploding in 2025, with car sales jumping nearly 97% in the first half of the year to 74,490 units from 37,830 a year ago. This surge pits the growing popularity of affordable Chinese brands against the government’s drive to boost local car assembly and cut imports.

Chinese Brands Take the Lead

Chinese cars now hold a strong 37.1% share of Egypt’s market in the first half of 2025, up from 31.9% last year. Buyers love their low prices, advanced features like 360-degree cameras and auto-parking, and solid safety ratings.

This shift affects all buyers, even those who once spent big on luxury models. One industry insider noted that people question paying millions for features they can get in a Chinese car for much less. Brands like Chery, MG, and BYD lead the pack, with Chery topping sales charts.

Electric vehicles from China are also gaining ground, with EV sales up 39.5% in the first quarter. This ties into global trends where Chinese makers dominate affordable EVs.

In January 2025, Chinese passenger cars sold 3,301 units, almost double the previous year’s figure. Their appeal comes from good after-sales service and local dealers with decades of experience.

Government Push for Local Assembly

Egypt launched its National Strategy for Localizing the Automotive Industry in 2022 to build a homegrown car sector. The goal is to meet rising demand without draining foreign currency on imports.

The 2024/2025 budget set aside 1.5 billion Egyptian pounds to support this plan. Seven companies have joined, and three have started claiming incentives.

Local assembly jumped 94% in the first half of 2025, showing real progress. Factories now produce models from brands like Hyundai and Chevrolet, which grabbed the top spot this year.

Deals with Chinese firms are key. For example, a major Chinese company signed a $1 billion deal to set up assembly lines in Egypt. This blends foreign tech with local jobs.

Proton from Malaysia and Geely from China have opened plants, aiming to make seven Chinese brands locally by 2026.

Key Challenges and Opportunities

Building a strong local industry faces hurdles like high import costs for parts and slow EV adoption. Egypt’s economy is recovering, which helps sales, but currency issues linger.

Chinese momentum brings competition that pushes local makers to improve. Experts predict Chinese cars could dominate if they keep assembling locally.

On the bright side, these investments create jobs and tech transfers. One factory in Giza shows smooth teamwork between Egyptian workers and Chinese tech, producing cars with premium features at lower costs.

EV trends offer big chances. With global shifts to green transport, Egypt aims to grow its electric market, supported by Chinese know-how.

- Job Creation: New factories could add thousands of positions in assembly and parts.

- Export Potential: Local production targets sales to Africa and Europe.

- Consumer Savings: Assembled cars avoid some import taxes, lowering prices.

Market Leaders and Sales Data

Chevrolet leads brands in the first half of 2025 with 14.6% market share, followed by Nissan at 14.4% and Chery at 11.7%. Hyundai and MG round out the top five.

Sales data highlights the shift. Here’s a quick look at top performers:

| Brand | Market Share H1 2025 | Change from 2024 |

|---|---|---|

| Chevrolet | 14.6% | Up from #5 |

| Nissan | 14.4% | Steady |

| Chery | 11.7% | Strong growth |

| Hyundai | 11.0% | Rising fast |

| MG | 10.0% | Gaining |

BYD slipped to 12th, but overall Chinese brands thrive. Total vehicle sales surged 97%, with passenger cars leading.

Future Outlook for Egypt’s Auto Sector

Experts see continued growth if economic recovery holds. Passenger car sales should rise further, driven by better incomes and more options.

Local assembly could balance the Chinese influx by making those brands “Egyptian-made.” This might ease import reliance and boost exports.

Watch for more EV models as charging networks expand. The market’s transformation shows how global trends meet local needs.

What do you think about this auto market shift? Share your thoughts in the comments and pass this article to friends interested in cars or Egypt’s economy.