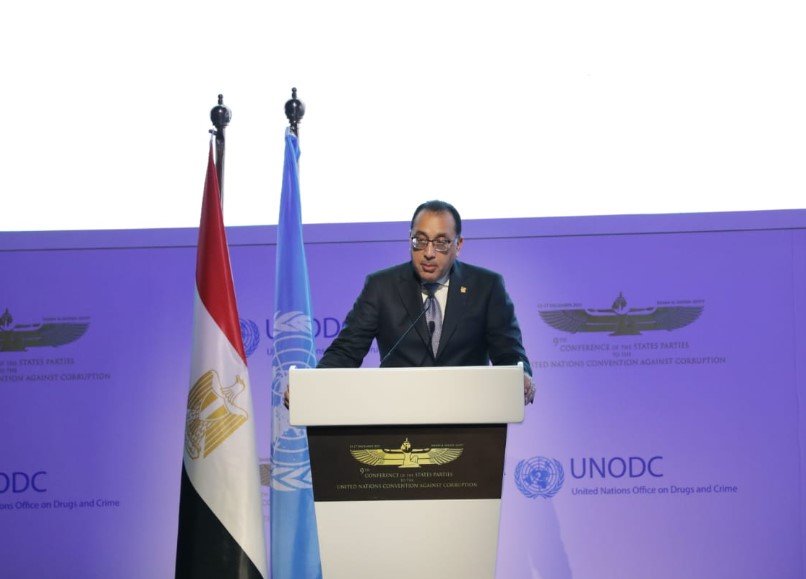

Egyptian Prime Minister Mostafa Madbouly strongly defended the government’s strategy to partner with private investors on unused state-owned lands during a cabinet meeting on August 13, 2025, in Cairo. He rejected claims that the move amounts to selling off national assets, highlighting how such partnerships could unlock economic value from neglected sites along the Nile and in historic districts.

Background on Egypt’s Asset Utilization Efforts

Egypt has long grappled with underused public lands amid economic pressures, including inflation and foreign currency shortages. In recent years, the government has ramped up initiatives to involve the private sector in developing these assets, building on plans announced as far back as 2022 to attract billions in investments.

This latest push comes as Egypt seeks to boost its economy after securing major foreign deals, such as the $35 billion UAE investment in Ras El Hekma in 2024. Officials aim to generate jobs and revenue by transforming idle properties into productive ventures.

The focus includes prime locations like the Nile Corniche, where lands currently serve as warehouses or garages despite their high potential value.

Madbouly’s Key Arguments Against Criticism

Prime Minister Madbouly addressed critics directly, expressing surprise at accusations of asset squandering. He explained that leaving valuable lands unused wastes resources, especially when they could support tourism and real estate projects.

He stressed that the plan involves partnerships, not outright sales, allowing the state to retain ownership while gaining benefits. Madbouly pointed out the irony: past complaints targeted government overreach, but now offering opportunities to private firms draws backlash.

During the meeting, he called for a full inventory and valuation of these assets to identify the best investment paths. This approach, he said, aligns with global practices where historic sites are repurposed without losing their identity.

Madbouly also referenced successful international models, like turning old streets into pedestrian zones, to show how Egypt could modernize while preserving heritage.

Targeted Areas for Development

The government has pinpointed several key zones for this initiative, starting with a rapid assessment of Nile Corniche lands in Cairo districts. These areas hold immense value, potentially worth tens of billions of Egyptian pounds.

Other historic spots like Khedivial Cairo, Azbakeya, and Fustat Hills are part of an integrated replanning effort. The vision includes creating promenades, hotels, and commercial spaces that respect architectural heritage.

Madbouly emphasized that no demolitions or identity changes will occur for protected buildings. Instead, the focus is on adaptive reuse to bring life back to these neighborhoods.

- Nile Corniche: Unused plots eyed for tourism and real estate.

- Khedivial Cairo: Replanning to include pedestrian-friendly zones.

- Azbakeya and Fustat Hills: Opportunities for mixed-use developments.

This selective targeting aims to maximize returns without compromising cultural significance.

Economic Benefits and Job Creation

By partnering with private investors, Egypt expects to create a ripple effect of economic gains. Madbouly highlighted how developed projects would form operating systems that generate jobs, added value, and tax income.

For instance, converting a simple garage into a hotel could employ hundreds and attract tourists, boosting local businesses. This fits into broader goals, like the 2022 plan to draw $40 billion in investments over four years by privatizing certain sectors.

Recent data shows Egypt’s economy growing at about 4% in 2025, but officials believe asset optimization could push it higher. The strategy also supports initiatives like the 1.5 Million Feddan Project, which reclaims land for agriculture and development.

| Aspect | Potential Impact |

|---|---|

| Job Opportunities | Thousands of new positions in construction, tourism, and services |

| Revenue Generation | Tens of billions in asset value unlocked through partnerships |

| Tax Income | Increased from operational projects and businesses |

| Economic Growth | Contribution to overall GDP boost, targeting 8% annual rate for improved living standards |

These outcomes address Egypt’s need for one million new jobs yearly to match population growth.

Addressing Public Concerns and Criticisms

Critics worry that offering state lands could lead to privatization at the expense of public access, especially in cherished areas like the Nile waterfront. Some social media users have voiced fears of foreign takeovers, drawing parallels to past deals like the UAE’s Ras El Hekma investment.

Madbouly countered by assuring that partnerships ensure state control and public benefits. He urged citizens to see the bigger picture: idle assets drain resources, while development creates shared prosperity.

Balancing these views, the government plans transparent processes, including public consultations on major sites. This responds to sentiments expressed online, where discussions mix support for economic revival with calls for heritage protection.

Looking Ahead to Implementation

The prime minister has directed officials to speed up inventories, with initial offerings expected soon. This ties into Egypt’s wider reforms, such as the Integrated National Financing Strategy launched in March 2025, which emphasizes sustainable investments.

Future steps include monitoring progress through bodies like the Coordinating Council for Fiscal and Monetary Policies. By involving Gulf investors and local firms, Egypt aims to sustain momentum from recent negotiations.

As these plans unfold, they could reshape Cairo’s landscape, blending history with modern needs. Readers, what do you think about this approach? Share your thoughts in the comments and spread the word to keep the conversation going.